Significant changes to the Polish Holding Company

- Corporate tax, INSIGHT

- [rt_reading_time label= postfix="minutes" postfix_singular="minute"]

The Polish Holding Company (PHC) is a solution that has been effective in the CIT Act since 1 January, 2022 and is intended to encourage investors to invest through Polish holding companies in other entities. In principle, the PHC allows for an exemption from taxation of dividend income paid by a Polish/foreign subsidiary to a Polish holding company and an exemption from taxation of income from the disposal of shares in such a subsidiary to an unrelated party. However, the introduced regulations required clarification and changes that would make the provisions practically applicable and ensure the competitiveness of the PHC in comparison with solutions effective in other countries. Some of these demands are being implemented in the amendment to the CIT Act, which is to be effective from 1 January, 2023.

Changes to the scope of tax preference

The first fundamental modification is the introduction of an exemption from taxation of 100% of dividend income distributed to a Polish holding company, instead of the current 95% exemption.

In order to apply the exemption from taxation of dividends distributed by a foreign subsidiary, the PHC must ensure that the company does not meet the criteria for qualification as a controlled foreign company (CFC) under Article 24a(3) (3) (b) and (c) of the CIT Act. The amendment provides that the above requirement must be met in the tax year of the dividend distribution and in any of the 3 years preceding the year of distribution (instead of the 5 years currently provided for). Meeting this condition is still irrelevant if the foreign subsidiary is subject to taxation on all its income in an EU/EEA country and carries out substantial real economic activity there.

The rules on the exemption from taxation of income from the disposal of shares in a Polish or foreign subsidiary by a Polish holding company to an unrelated party remain unchanged. The exemption applies on the assumption that at least 50% of the value of the assets of the subsidiary (domestic or foreign), directly or indirectly, do not consist of real estate located in Poland or rights to such real estate. Still, in order to apply the exemption on the capital gains, it is necessary for the Polish holding company to submit a statement of its intention to use the exemption, to the head of the tax office competent for it, at least 5 days before the disposal.

The applicability of PHC from 2023

In order to apply the PHC model, the legislator has provided for a number of conditions that must be met by the Polish holding company and the subsidiary (domestic or foreign). The amendment to the CIT Act provides for changes aimed at relaxing some of the requirements and thus increasing the number of taxpayers who will be able to apply the PHC regulations.

Modification of the conditions set for PHC

The amendment provides for the extension of the PHC to companies operating in the form of a simple joint-stock company [prosta spółka akcyjna] (also limited liability company [spółka z ograniczoną odpowiedzialnością] and a joint-stock company [spółka akcyjna] may become a Polish holding company), and the removal of the impossibility of combining the dividend exemption under the PHC with the dividend exemption provided for in Articles 20(3) and 22(4) of the CIT Act (participation exemption).

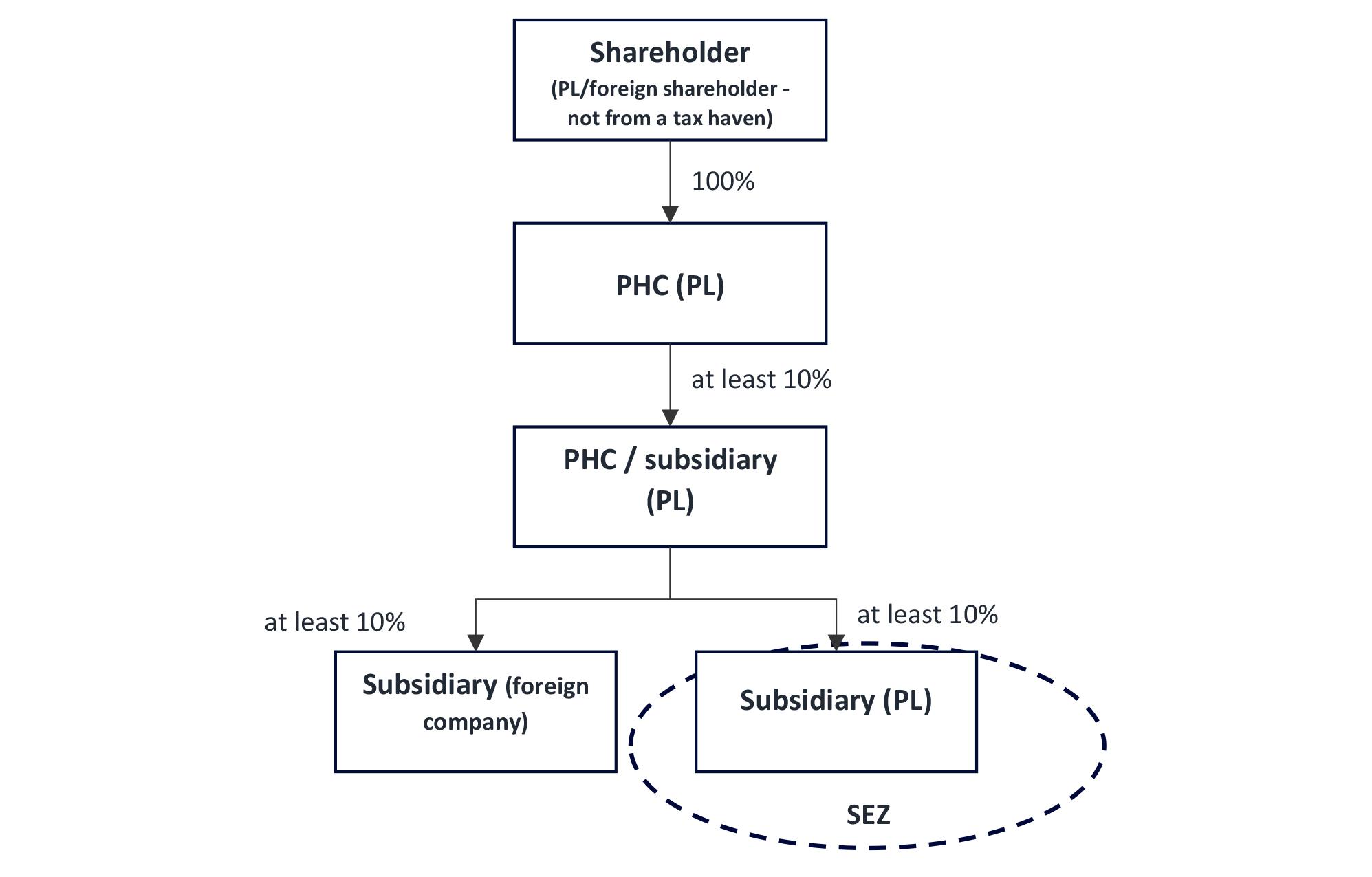

Still, the Polish holding company should directly hold at least 10% of the shares of the subsidiary for a certain period of time and conduct genuine economic activity. This company cannot form a tax capital group and benefit from exemptions on income from activities carried out in a special economic zone (SEZ) or within the Polish Investment Zone (PIZ). In addition, the condition according to which a shareholder of a Polish holding company cannot be, directly or indirectly, an entity having its registered office in a country applying harmful tax competition has not been changed.

While the above changes should be considered favourable, it should also be correct to relax the obligation for a Polish holding company to determine that its direct or indirect shareholders are not seated/registered in the so-called ‘tax havens’. The necessity of the absolute fulfilment of the aforementioned condition both with regard to direct shareholders as well as to entities at higher levels of the shareholding structure is confirmed by individual advance tax ruling issued this year, e.g. Ruling of the Director of the National Fiscal Information of 7 September 2022, no. 0111-KDIB1-3.4010.445.2022.1.JKU.

Undoubtedly, when introducing new tax preferences, the legislator should include provisions that would limit their abuse for tax avoidance purposes. Nevertheless, the aforementioned obligation cannot be unlimited and, in practice, exclude certain categories of entities from the possibility of applying the PHC, thus differentiating the situation of taxpayers without good reason. For example, listed companies with a dispersed shareholding will not benefit from the PHC if they cannot prove that their direct and indirect shareholders are not resident of or domiciled in a tax haven. According to the amendment, this condition must have been met continuously for at least two years preceding the date of distribution of the dividend or disposal of the shares. It is easy to imagine a situation where, for example, during the above period, a minimum block of shares in a listed company is acquired by a company one of whose shareholders is seated/registered in the tax haven but disposed of after only a few days of holding. Also in such a case, the listed company will not be able to apply the exemptions in the PHC model. The above regulation should therefore be modified by limiting the identification obligation to, for example, shareholders with a certain percentage of shareholding.

Relaxation of the conditions for a subsidiary and extension of the minimum holding period of shares to 2 years

The amendment provides for the modification, and in some cases the abolition, of several existing requirements for a company to be recognised as a Polish or foreign subsidiary:

- from next year onwards, a subsidiary will be able to apply exemptions from taxation on income from activities carried out in the SEZ or under the PIZ, what is impossible under the regulations binding till the end of 2022 and therefore this criterion raised doubts as it implied discrimination against entities that invest in Poland and create jobs. In addition, SEZ exemptions apply to income earned from a source of operating income, i.e. separately from capital gains, so there would be no combination of exemptions within a single source of income;

- a subsidiary will be able to hold all the rights and obligations in a partnership – however, the condition of not holding, inter alia, investment fund shares and other property rights as a founder (beneficiary) of a foundation or trust has been retained;

a subsidiary will be allowed to hold more than 5% of the shares in the equity of another company – this is one of the most important changes provided for in the amendment, as it allows the application of the PHC regime by companies belonging to multi-level structures. Consequently, PHC can also be used at, for example, two levels in the structure:

The conditions according to which a domestic subsidiary may be a Polish tax resident company (limited liability company, joint-stock company) in which at least 10% of the shares are held by a Polish holding company and which does not form a tax capital group remain unchanged. In the case of a foreign subsidiary, it is necessary that the company has legal personality, does not apply tax exemption on its entire income and does not have its registered office in a country applying harmful tax competition.

Controversial starting date for the PHC model

According to the amendment, all the conditions provided for on the side of the Polish holding company and the (Polish or foreign) subsidiary should be fulfilled as of the date preceding the receipt of dividend income or the disposal of shares, continuously for a period of at least two years (compared to one year in force in 2022). Thus, the period of fulfilment of the aforementioned conditions has been aligned with the holding period for the participation exemption for dividends from the companies from EU/EEA countries. One should remember that this exemption is available to a Polish company in the case of direct holding of at least 10% of shares in a subsidiary (based in Poland or another EU/EEA country) for an uninterrupted period of at least two years, however, this period may expire after the date of dividend distribution. In the case of dividend distributions, the conditions for the participation exemption are therefore more lenient than in the case of PHC. It is worth bearing in mind, however, that the PHC regime can also be applied to foreign subsidiaries outside the above-mentioned areas.

In our opinion, under the PHC model, the period of fulfilment of the conditions, including the holding of shares in the subsidiary, should be calculated from the date of acquisition of shares. In the transitional provisions to the amendment of the CIT Act introducing the PHC model, the legislator only indicated that the exemption applies to dividends distributed after 31 December 2021. Initially, the above view was also shared by the tax authorities. The Director of the National Fiscal Information confirmed that the condition of holding shares in a subsidiary for at least one year should be met as at the date of the transaction (e.g. ruling of the Director of the National Fiscal Information of 26 April 2022, No. 0111-KDIB1-1.4010.23.2022.2.JD).

An analogous transitional provision has been introduced to the current amendment to the CIT Act, according to which the exemption under the PHC applies to income (revenue) earned from 1 January, 2023 (i.e. from the effective date of the amendments). However, the transitional provisions are silent as to the date from which the period of fulfilment of the PHC conditions, including the holding of shares, should be counted. We can read an explanation in the explanatory memorandum to the current amendment, which indicates that the legislator’s intention was that the moment the PHC provisions enter into force should be at the same time the moment when the period during which the conditions stipulated in the provisions should be fulfilled, and thus also the time of holding shares, starts to run.

Similarly, it follows from recent rulings of the Director of the National Fiscal Information which confirm that the period of holding shares in a subsidiary should be calculated from the date of entry into force of the PHC regulations, i.e. from 1 January, 2022, e.g. individual advance tax ruling of 6 October, 2022 no. 0111-KDIB1-3.4010.456.2022.3.IZ. Consequently, taking into account the change in the period of fulfilment of the PHC conditions, including the holding of shares from one year to two years, 2024 will be the first year in which the taxpayer will be able to apply the exemptions provided for under the PHC.

The above approach does not correspond to the wording of the legislation and introduces undue hardship, particularly in relation to the sale of shares in a subsidiary. In the case of dividend distributions, in many cases it will be possible to take advantage of the participation exemption on dividends paid by EU/EEA subsidiary, where the holding period of the shares may lapse after the date of the profit distribution. The legislator should explicitly indicate in the regulations from which point in time the holding period should be calculated. If there is no such regulation, it should be assumed that the period of fulfilment of the conditions of the PHC starts on the date of acquisition of the shares of the subsidiary and ends on the day before the payment of the dividend or disposal of the shares. Entrepreneurs should not be at the mercy of a legalistic interpretation by the tax authorities or a long court battle.

No need for the pay and refund mechanism

Another upcoming change is the introduction of an exemption to the CIT Act for the pay and refund mechanism in relation to dividends distributed by a subsidiary to a holding company within a PHC. This will ensure that when dividends are distributed in excess of PLN 2 million, there will be no obligation to collect and pay tax and then claim a refund. This is therefore an incentive to apply PHC as compared to the existing dividend exemption.

PHC and the new holding law

The planned amendments to the CIT Act concerning PHC involve the introduction of a new regulation for groups of companies provided for in the amendment to the Code of Commercial Companies and Partnerships, which came into force on 13 October, 2022. The amendment to the Code of Commercial Companies and Partnerships enables the creation of a formal group of companies (a group disclosed in the National Court Register) guided by a common interest, which should contribute to better management and operation of the group. Parent companies have gained an additional tool for issuing binding instructions to subsidiaries with regard to the conduct of their business, which should also contribute to more efficient group management. In turn, the members of the management of a subsidiary will not be liable for damage caused by the execution of a binding instruction. In practice, the above modifications should contribute to increasing the security of operations of the management boards of subsidiaries, as well as protecting the interests of the group. The amendment to the Code of Commercial Companies and Partnerships is important insofar as it may contribute to an increased interest in the formation of holding companies, which in turn may be interested in applying the preferential taxation model under the PHC.

Another amendment to the Code of Commercial Companies and Partnerships is also envisaged and it will introduce new regulations concerning reorganisation processes (the amendment is at the consultancy stage; the planned effective date is 31 January 2023). The proposed amendments may be relevant for the application of the PHC when taking advantage of preferential taxation will require making changes to the existing group structure, for example, by transferring the holding company to Poland. By virtue of the amendments to the Code of Commercial Companies and Partnerships, new possibilities of cross-border reorganisations will be introduced, including divisions and cross-border transformations, i.e. migration of companies from the country of their registered seat to another country, including Poland, without liquidation. In domestic transactions, among other things, the amendment plans to introduce a new type of simplified merger, without the need to allot shares of the acquiring company to the shareholder of the acquired company, inter alia, when one shareholder holds directly or indirectly all shares of the merging companies. Thus, companies wishing to apply the PHC, will have a wider range of possibilities and legal instruments to make reorganisation changes in the group structure.

Similarly to the amendments to the provisions of the CIT Act regulating the application of the PHC, the above amendments to the provisions of the Code of Commercial Companies and Partnerships are aimed, among others, at increasing the competitiveness of Polish legal and tax solutions concerning holdings and the attractiveness of the Polish market for foreign investors. While these changes do not completely eliminate doubts and risks related to the application of the new holding law, they certainly constitute a good step towards the approximation of Polish legislation to EU legal regulations.

Legal Grounds:

Articles 20, 22, 24m-24p of the Corporate Income Tax Act of 15 February 1992 (Journal of Laws 2021, item 1800 as amended).

Article 1 (21), (22), (23b), Article 20(1) and (8) of the Act of 15 September 2022 on amending the Corporate Income Tax Act and certain other acts (Journal of Laws 2022, item 2180).

Article 1 of the Act of 9 February 2022 on amending the Act – Code of Commercial Companies and Partnerships and certain other acts (Journal of Laws of 2022, item 807).

Articles 1, 2 and 3 of the Bill of 1 July 2022 on amending the Act – Code of Commercial Companies and Partnerships and certain other acts (Government Legislation Centre list no.: UC123).

Magdalena Zamoyska

Partner | Tax adviser

Tel.: (+48) 606 234 976

Monika Grobelska

Senior consultant